22+ paycheck calculator wv

Switch to West Virginia hourly calculator. The Paycheck Calculator widget allows you see the impact of changing salary timesheet deduction or tax information will have on your pay check by allowing you to calculate a mock paycheck.

West Virginia Paycheck Calculator Smartasset

Ad Compare Prices Find the Best Rates for Payroll Services.

. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. How to calculate annual income. Calculating paychecks and need some help.

The West Virginia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and West Virginia State Income Tax Rates and Thresholds in 2022. West Virginia Paycheck Calculator. West Virginia Paycheck Calculator.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Work out your adjusted gross income Net income Adjustments Adjusted gross. This West Virginia hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Computation of these amounts is based on application of the law to the. A financial advisor in West Virginia can help you understand how taxes fit into your overall financial goals. This free easy to use payroll calculator will calculate your take home pay.

CP Date Calculator - used to determine Certified Permanent date for employees who have reduced FTE or Leaves during Probationary. It should not be relied upon to calculate exact taxes payroll or other financial data. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in West Virginia. As an employer in West Virginia you have to pay unemployment compensation to the state. Switch to West Virginia salary.

Some states follow the federal tax year some states start on July 01 and end on Jun 30. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Similar to the tax year federal income.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Make Your Payroll Effortless and Focus on What really Matters.

Calculating your West Virginia state income tax is similar to the steps we listed on our Federal paycheck calculator. Below are links to several calculators and calendars to assist you. Calculate your West Virginia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free West Virginia paycheck calculator.

Check out our new. The 2022 rates range from 15 to 85 on the first 12000 in wages paid to each employee in a calendar year. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

Important note on the salary paycheck calculator. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the. If youre a new employer congratulations on getting started you.

Supports hourly salary income and multiple pay frequencies. Annual Increment Pro-Rata Calculator. The Online Calculator for Interest and Additions to Tax Tax Calculator is designed to assist Taxpayers in calculating interest and additions to tax due relating to West Virginia tax liabilities.

This widget also displays previous pay check calculations. So the tax year 2022 will start from July 01 2021 to June 30 2022. Select a highlighted area.

The state tax year is also 12 months but it differs from state to state. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Annual Leave - Use or Lose Calculator.

Well do the math for youall you need to do is enter the applicable information on salary federal and. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in West Virginia. Details of the personal income tax.

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Entact Reviews Glassdoor

Pdf 2015 Risp Web 2 Pdf Sheryl A Larson Academia Edu

West Virginia Hourly Paycheck Calculator Gusto

West Virginia Salary Calculator 2022 Icalculator

California Food Stamps Eligibility Guide Food Stamps Ebt

Gross Pay Calculator Adp

West Virginia Paycheck Calculator Tax Year 2022

Chelsea Greene Apartments 28 Roosevelt St Shinnston Wv Rentcafe

![]()

West Virginia Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Ws 2019 3 20 Bestratedapp Ae Ar Ae Apps Apps All Windows Desktop All Windows Desktop 11810 1001 0 0 True 0 200 2 Txt At Master Livedesktop Ws 2019 3 20 Github

Free Paycheck Calculator Hourly Salary Usa Dremployee

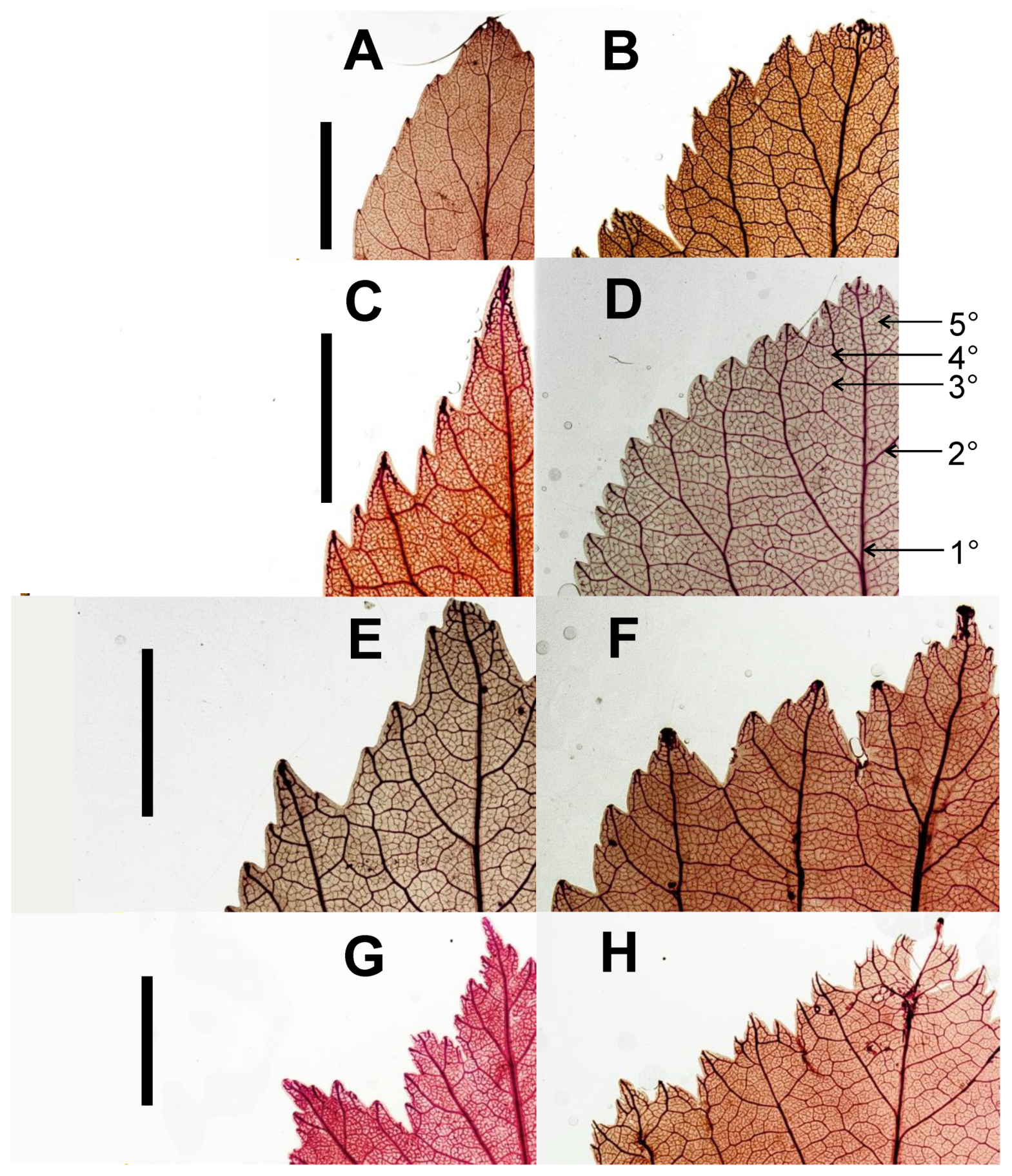

Agronomy Free Full Text Niche Shifts Hybridization Polyploidy And Geographic Parthenogenesis In Western North American Hawthorns Crataegus Subg Sanguineae Rosaceae Html

443 Salaries At Nelson Shared By Employees Glassdoor

Ets 08 16 Mitsubishi Evo X Intake

![]()

Stormtracker 59 Wvns By Nexstar Broadcasting Inc More Detailed Information Than App Store Google Play By Appgrooves Weather 7 Similar Apps 13 Reviews

Chelsea Greene Apartments 28 Roosevelt St Shinnston Wv Rentcafe